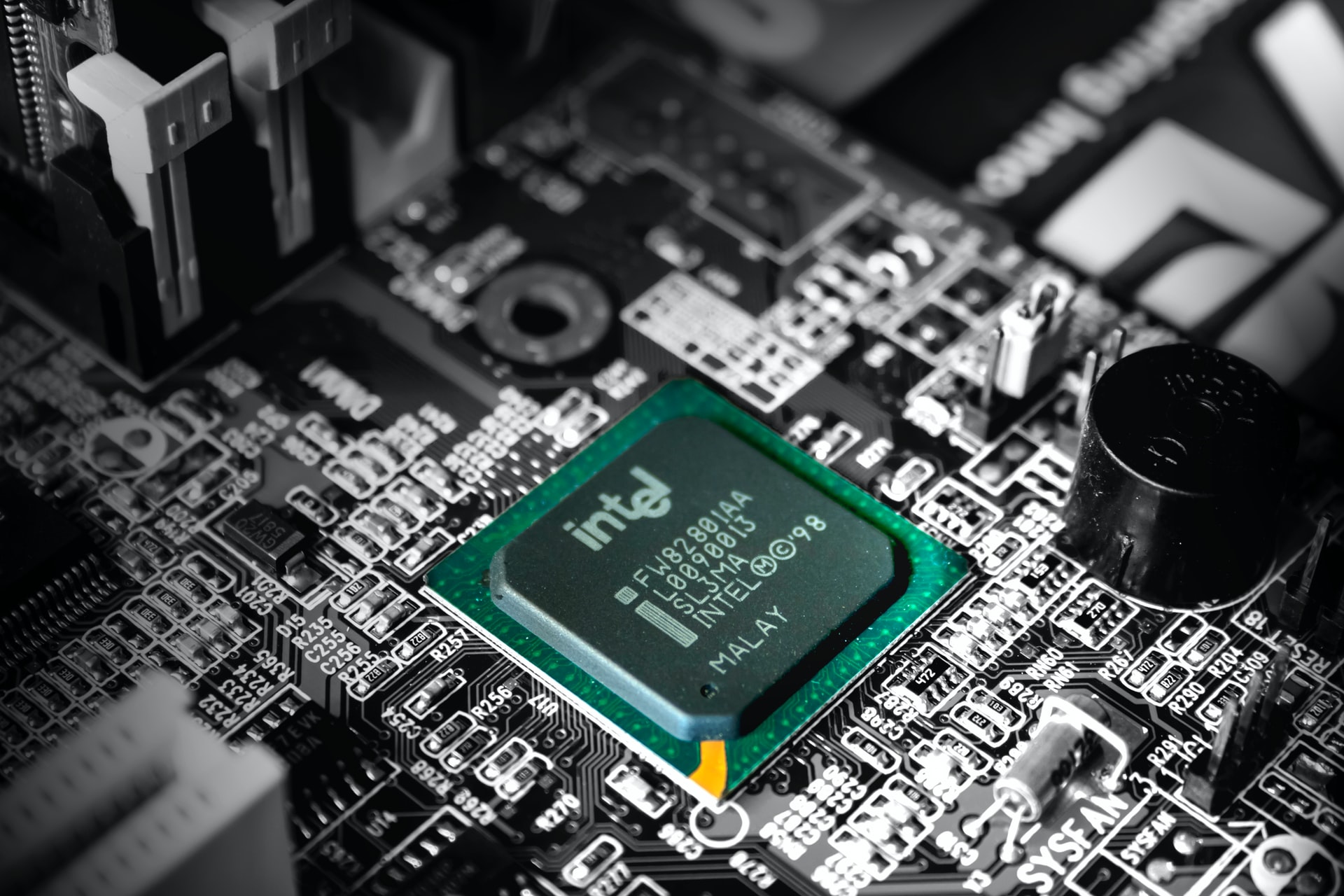

A global shortage of computer chips is affecting everything from the gaming and cryptocurrency industries to auto manufacturers and, yes, high performance computing.

A Perfect Storm

A significant gap between supply and demand, coupled with the crippling effects of the global pandemic, has created a perfect storm of increased demand and short supply. Starting in March 2020, Covid-19 caused a huge increase in the number of people working from home, which drove demand for PC and cell phone sales. It also created a boom for cloud computing services, increasing the demand for chips even further.

The shortage of chips was worsened when a fire devastated chipmaker Renesas Electronics’ plant in Naka, north of Tokyo, on March 19, 2020. The plant suffered extensive damage and has yet to return to full production.(2)

This perfect storm of events has brought us to where we are now, where delivery lead times that once took a few weeks at most for some critical server chips have been extended to 52 – 70 weeks. (3)

Both AMD and Intel have announced supply shortages for CPUs, GPUs, and memory chips.

AMD CEO Dr. Lisa Su announced at an investor event in May 2020 that the company has been forced to prioritize its higher end chips over lower-powered parts due to shortages. Citing the CPU shortage, AMD has put the brakes on releasing products for the lower-end CPU market. (4)

AMD’s 2nd Generation (Rome) and 3rd Generation (Milan) EPYC server CPUs remain highly sought after in the marketplace. The supply of 2nd Gen Rome is barely sufficient to meet current production needs, and the supply of 3rd Gen Milan is not much better. Vendors report there will be “small pockets of supply” for 3rd Gen Milan at the end of Q321 and beyond.

Intel Corp.’s new CEO Pat Gelsinger has said the global chip supply shortage might last as long as two years. “This will take a while until people can put more capacity in the ground,” he said in an interview. “It’s just the way it is when you’re building new factories.” (5)

The trouble is trickling down to every component

Servers do not operate using CPUs alone, of course, and the supply of small components is troubled as well. Everything from BMC chips down to resistors, capacitors, and circuit boards is tight, said Manoj Sukumaran, senior enterprise IT analyst with Omdia.

Network switch vendors are dealing with long lead times on the silicon they need to meet their forecasted delivery times.

According to Jayshree Ullal, CEO of Arista Networks, which is one of the largest data center networking switch vendors, “The supply chain has never been so constrained in Arista history. To put this in perspective, we now have to plan for many components with 52-week lead time. COVID has resulted in substrate and wafer shortages and reduced assembly capacity.”(6)

Arista isn’t alone. The scope of this challenge is industry-wide. Executives for Broadcom, Cisco and Juniper have all discussed extended lead times in their most recent earnings calls. Broadcom CEO Hock Tan said part of the problem was that customers were now ordering more chips and demanding them faster than usual, hoping to create a buffer against the supply chain issues. (6)

The supply situation is made worse by a recent lockdown in Malaysia, where more than 50 semiconductor plants are based. They all are expected to face further supply issues in a country where, even with government approval, manufacturers including Infineon, NXP and Renesas are only allowed to run at 60%. Samsung’s production factory in Malaysia is among those functioning at 60%, and the company has no way of recovering its production timeline.(7)

All of these shortages are resulting in price increases that are being seen industry-wide:

- Memory pricing continues to rise by 3-5% per quarter, and market pricing is following suit. The supply issues are expected to get even worse in Q321. Memory shortages that were already being experienced over the past quarter are expected to get worse. Shortages are expected to persist through 2022. (7)

- RAID controllers are also in short supply due in part to the recent crackdown on cryptomining in China and Hong Kong. For example, RAID controller lead times have stretched from 28 weeks to 42 weeks, so expect fierce competition for the upcoming allocation. (7)

- InfiniBand cards and Ethernet adaptors have booking lead times of 4-6 months. Mellanox is limiting booking allocations to 500 pieces per month for Ethernet adapters and InfiniBand cards (combined SKUs, not 500 pieces per single SKU). Once again, world events are adding to the problems. Conflicts between Israel and Palestine has slowed the production of Ethernet cards because factory workers are unable to get back to work. Less-profitable SKUs are being transferred to production plants in Taiwan, China, India, and Malaysia. (7)

- Intel’s network cards are in short supply and have seen a recent spike in demand. Intel is now allocating more of its substrate supply to the production of mobile CPUs in hopes of gaining traction against AMD in this segment. This is making the supply of Ethernet cards even more limited as Intel turns its attention away from network cards. (7)

The shortage of server components is not expected to to ease until late 2022 at the earliest, and many analysts believe that the situation could be extended beyond that.(3)

Sources:

(1) “Bitcoin and Chip Makers Are Caught in a Bad Romance,” published by The Wall Street Journal

https://www.wsj.com/articles/bitcoin-and-chip-makers-are-caught-in-a-bad-romance-11615536301

(2) “Everything You Need to Know about the Chip Shortage That’s Plaguing Automakers,” published by The Detroit Free Press

https://www.freep.com/story/money/cars/2021/06/15/car-chip-shortage-2021/7688773002/

(3) “Chip Shortage for Datacenter Market is Worsening Amidst Low Supply from Manufacturers,” published by TechnoSports

https://technosports.co.in/2021/07/05/chip-shortage-for-datacenter-market-is-worsening-amidst-low-supply-from-manufacturers/

(4) “Chip Shortage Causes AMD to Pivot Away From Lower End PC Processors,” published by PC Mag

https://www.pcmag.com/news/chip-shortage-causes-amd-to-pivot-away-from-lower-end-pc-processors

(5) “Intel CEO Sees Prolonged Chip-Supply Constraints,” published by The Wall Street Journal

https://www.wsj.com/articles/intel-earnings-first-quarter-2021-11619043954

(6) “It’s Little Things – How the Chip Shortage is Affecting the Data

Center Industry,” published by DataCenter Knowledge.com

https://www.datacenterknowledge.com/business/its-little-things-how-chip-shortage-affecting-data-center-industry

(7) “The Green Sheet,” published by Fusion Worldwide

https://www.fusionww.com/current-fusion-greensheet/

Yes! I want to talk about expediting my order now to avoid further delays and price increases being caused by the global supply chain issues.

Your Next Steps ....

The main takeaway from this discussion of supply chain challenges is that there will be delays that last for at least a year.

If you want something delivered soon, you need to get your name on a waiting list now. Many SKUs will be unavailable or on back order.

Save your place in line because we know for certain there will be a line – a long line – of people waiting to get their HPC equipment amid these shortages.Here are some steps you can take now:

• Start by asking yourself: Can I be flexible with the configuration of my system? Reason: Not every SKU has the same lead time. If you wanted a 32-core CPU, could a 28-core CPU be an acceptable alternative if it meant getting the system sooner? Contact us to discuss options and strategies to get what you need as soon as possible.

• Get your purchasing department involved in your plans now. Explain the sorts of delays that are taking place and the need for expedience.

• If you are working on a government project that has DPAS priority, this could help expedite your order. Be sure to let us know so that we can make sure your project is at the front of the line.